What is SWOT Analysis?

A SWOT analysis is a framework used by financial analysts or management consultants to understand the internal and external forces that may determine an organization’s strengths, weaknesses, opportunities, and threats in a specific business environment. Swot Analysis is a method for conducting strategic planning and management and is referred to as situational analysis or situational assessment. The primary objective of a SWOT Analysis is to support firms in determining and analyzing awareness of the external aspects involved in choosing a course of action.

Factors of SWOT Analysis:

Internal Factors of SWOT Analysis: Strengths and Weaknesses are the internal factors of SWOT Analysis that are under the control of the business owner. By evaluating these variables, one can conclude that weaknesses can be turned into strengths while comprehending the strengths and using them to meet organizational goals. Strengths are the characteristics of an organization that gives it a relative advantage over its competition whereas weaknesses are the characteristics of an organization that gives it a relative disadvantage over its competition.

External Factors of SWOT Analysis: Opportunities and threats are components of external factors of the SWOT Analysis that relate to changes in the market. By examining these variables, one may establish the areas where the organization may experience threats or opportunities for growth. The opportunities sector of the analysis should identify any external elements that might present chances for organizational growth. Threats are the elements of the outside world that pose serious threats to a company’s operations. Because opportunities and threats emerge from the external business environment, it is common to first conduct other types of analysis.

SWOT Analysis of Tata Motors Limited:

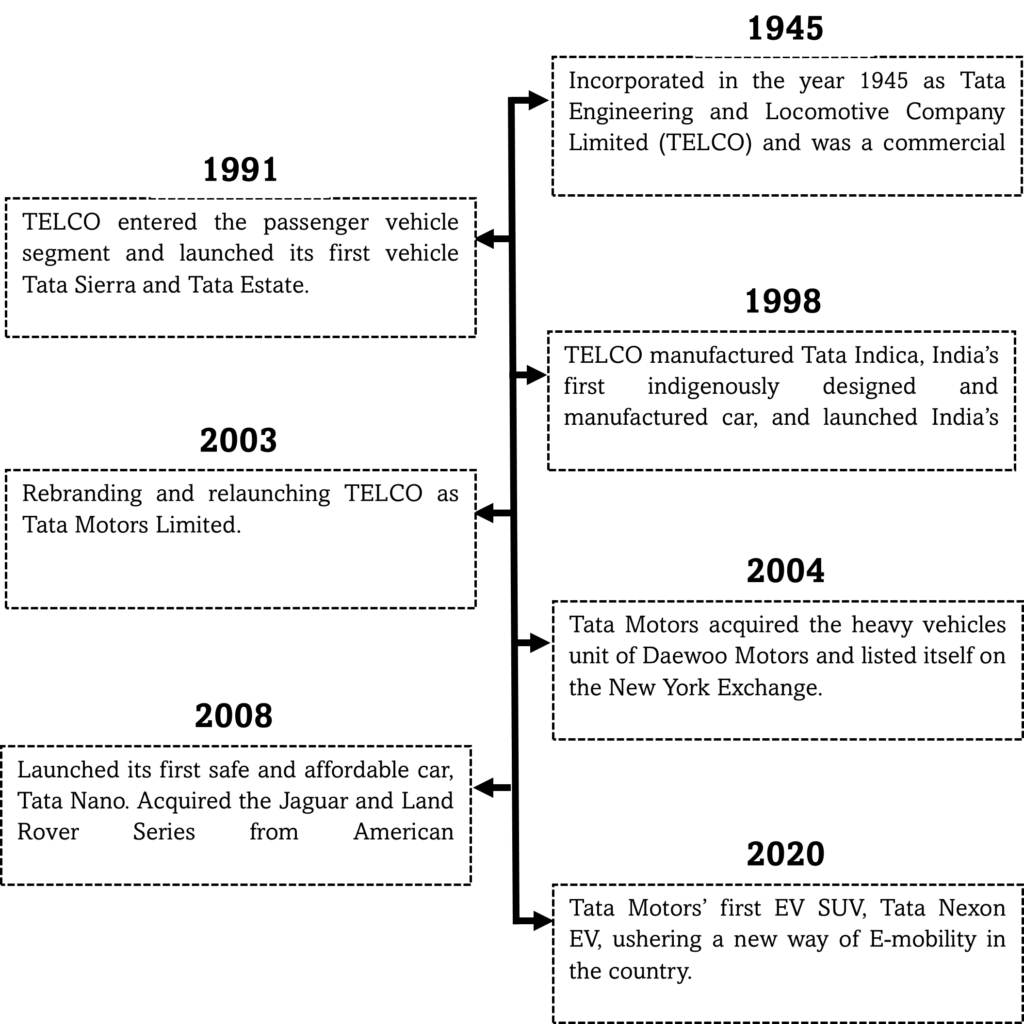

Founded in 1945, Tata Motors Limited, a part of Tata Group Conglomerate, is an Indian Multinational Automotive Manufacturing company and is the leading global automobile manufacturer with commercial, passenger and electric vehicle offerings. It is the biggest subsidy of Tata Group and has auto manufacturing and assembly plants located in various regions such as Jamshedpur, Pantnagar, Lucknow, Sanand, Dharwad, and Pune in India as well as in Argentina, South Africa, United Kingdom, and Thailand. Tata Motors has a network of 86 subsidiaries and more than 8 associate companies.

Timeline of Tata Motors:

Strengths:

- Multiple Product-lines: Tata Motors offers a wide selection of automobiles to meet the demands and tastes of various customers. It has a strong market presence in India. The market share of commercial vehicles is 44.9%, passenger vehicles is 12.1% and electric vehicles is 87%. Tata Motors thereby controls overall 14% of the Indian automotive market.

- Worldwide Presence: Tata Motors has a presence in over 125 countries, with a worldwide network made up of over 9,000 touch points. To meet the market’s increasing demand for vehicles, Tata Motors has built manufacturing facilities in multiple nations and exports to many others. The company’s global reach enables it to offset the economic downturns in some countries and diversify its revenue sources.

- Brand Reputation: Due to the strong brand recognition of the Tata Group, Tata Motors has been able to preserve its status as one of the biggest automobiles manufactures in the world by attracting customer loyalty. Customers benefit from the company’s offerings in terms of quality, dependability, and value for money.

- Product Innovation: To boost the functionality, safety, and efficiency of its cars, Tata Motors is dedicated to creating and implementing innovative technology. The Company’s investments in advanced driver assistance systems (ADAS), connected auto technologies, and electrified vehicles serve as evidence of its dedication to innovation. Tata Motors is focused on providing Sustainable Mobility Solutions.

- Vertical Integration: Tata Motors benefits from vertical integration inside the Tata Group, which comprises companies in industries including information technology, steel, and automotive components. The Company may save costs, uphold quality control, and streamline its supply chain thanks to this connection.

Weakness:

- Luxury Products: Tata Motors has expanded its potential to serve the luxury car sector of the automotive industry since acquiring Jaguar Land Rover. Compared to some of its international rivals, the company’s presence is still modest. Tata Motors might thereby miss prospects for expansion in the luxury car market, which frequently has better profit margins. According to industry estimates, 17,000 luxury vehicles were sold in the nation between January and June 2022, up 55% from the 11,000 units that were sold the year before.

- Competition: Tata Motors faces fierce competition from both domestic and foreign companies in the highly competitive automotive sector. Tata Motors is under pressure to keep up and maintain its market share since rivals like Maruti Suzuki, Hyundai, and Mahindra & Mahindra are always developing and releasing new models.

- Failures in internal controls: Any failure or weaknesses in the internal control system could materially and adversely affect the financial condition and results of the operations. The measures taken by Tata Motors may not be sufficient to satisfy their obligations as a public company and if they are unable to establish or maintain appropriate internal financial reporting controls and procedures, it could cause them to fail to meet their reporting obligations on a timely basis, resulting in material misstatements in the consolidated financial statements and harm the results of operations.

- Demand Forecasting: Poor forecasting of demand results either a shortfall in product supply or an overflow of supply of its products in the market. The fact that Tata generally struggles with demand prediction results in more inventories being kept both internally and, in the channel, which is one reason why the current stock is so different from its competitors.

- Dependence on the Indian Market: Because of the significant amount of Tata Motors’ revenue comes from the domestic Indian market, changes in the political and economic climate of the nation could have a big impact on the company. Due to its reliance on a single market, Tata Motors is at risk from changes in the Indian economy, consumer preferences, and regulations.

Opportunities:

- Growing Demand for Electric Vehicles: 16% of all emissions worldwide come from the road transport sector. The sale of electric vehicles has surged exponentially in recent years, due to their better range, expanded model selection, and improved performance. Regarding the software-intensive EV technology, Indian OEMs have a great chance to access international markets. In the next five years, Tata Motors anticipates that EV sales will account for 25% of all passenger vehicle sales.

- Future Developments: Better market development will lead to dilution of competitors’ advantages and enable Tata to increase its competitiveness compared to the other competitors due to its strengths.

- Increased Consumer Spending: Following a prolonged period of economic slump and weak corporate growth, the growth in consumer spending and the recovery in the economy presently will help Tata Motors with an opportunity to gain new customers and grow its market share.

- Transportation Costs: Reducing the cost of delivery due to lower transportation expenses can also lower the price of Tata’s products, providing the company the opportunity to increase productivity or provide benefits to customers to capture a larger market share.

- CNG powered vehicles: Tata Motors has made significant investments in CNG-powered vehicles, and these investments are starting to pay off. Due to rising diesel prices, which made CNG a more appealing option than diesel, demand for CNG-powered CVs spiked earlier in 2022. In the Tata Motors portfolio, CNG has so far contributed to over 16% of all CV sales for FY22, up from 3.4% in FY21.

Threats:

- Russia and Ukraine Conflict: In FY 21-22, Jaguar Land Rover recorded £43 million loss in relation to customer liabilities arising from sanctions imposed against Russia by many countries, preventing the shipment of vehicles and certain parts to the market. Over the past 3 years, Jaguar Land Rover has earned around 2.5% of revenue on average each year from Russia and Ukraine but has suspended vehicle exports to Russia to comply with recent export restrictions. Jaguar Land Rover continues to import a restricted range of safety-related parts to Russia for the repair of vehicles in market in compliance with relevant sanctions and export controls measures in place.

- Competitive Market: Competitors are creating innovative technology that could pose a severe challenge to the sector. Competitors from abroad are particularly strong and bring with them new technology, substantial financial resources, and global expertise.

- Unstable Product Demand: Because the market for highly profitable products is seasonal, any unlikely occurrence during the most lucrative period of the year could have a short- to medium-term negative effect on the company’s profitability.

- Shortage of Semiconductors: Semiconductors are an important component of the electrical architecture of the Tata Motors vehicle. The recent supply constraint of semiconductors has impacted the production schedules. The supply of semiconductors was impacted in 2021 because of the fire at the Renesas chip plant in Japan and extreme weather conditions in Texas during the winters.

- Supply Chain Disruption: Tata Motors, like other automakers, is susceptible to supply chain disruptions brought on by events like natural disasters, geopolitical unrest, and international pandemics. Such disruptions may cause output to lag and expense to rise, which would hurt the business’s bottom line. Additionally, Tata automobile sales have been impacted by supply chain interruptions brought on by lockdowns and dealership closures, which resulted in negative EBIT and free cash flows in the fiscal year 2022.

- Commodity Inflation: Prices of commodity items such as steel, nonferrous metals, precious metals, rubber and petroleum products have generally risen in recent years and more sharply in the recent past due to recent geopolitical conflicts. They may continue to rise significantly over the near term and in the future.

SWOT Analysis is a part of Feasibility Study. SWOT analysis is necessary for an organization to identify and understand the areas of improvement within the organization to grow exponentially. Conducting SWOT Analysis periodically will help the company and the management of the company to evaluate their visions to achieve the desired goals.

To know more about our process of conducting SWOT Analysis, click here.