Inflation is more than just a buzzword in economics; it is a key indicator that reflects the health of an economy and influences every individual’s daily life. In India, understanding the dynamics of the Consumer Price Index and Retail Price Index is crucial for both policymakers and consumers. This article dives deep into the difference in Consumer Price Index and Retail Price Index.

The Consumer Price Index (CPI) and the Retail Price Index (RPI) are both measures of inflation, but they differ in scope, methodology, and the specific items they include in their calculations. These differences can make them suitable for different uses, and they can provide varied insights into economic conditions.

What is Consumer Price Index?

The Consumer Price Index (CPI) is a critical economic indicator often used to assess changes in the cost of living and to measure inflation. Essentially, CPI provides a statistical measure of the average price changes in a basket of goods and services typically purchased by households over time. It is used by economists, policymakers, and government officials to gauge economic health and to make decisions regarding monetary policy, social security, and fiscal policies, among others.

What is the Retail Price Index?

The Retail Price Index in India measures the average price change in goods and services that households purchase for daily consumption. It differs from the Wholesale Price Index (WPI), which tracks price changes before they reach the consumer, at the wholesale level. The RPI is calculated by the National Statistical Office (NSO), which considers diverse items ranging from food and beverages to housing, clothing, and more, grouped under various categories.

Difference Between Consumer Price Index (CPI) and Retail Price Index (RPI)

| Consumer Price Index | Retail Price Index | |

| Scope and Use | CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is widely used to adjust pensions, wages, and for indexing personal tax allowances. Additionally, it serves as a key indicator for monetary policy decisions. | RPI is a measure of inflation that includes housing costs such as mortgage interest payments and council tax, which makes it broader than the CPI. It is commonly used to adjust some pensions, rents, and index-linked bonds. |

| Base Population | The CPI typically considers spending by residents in urban or metropolitan areas, including professionals, the self-employed, the poor, the unemployed, and retired people, but excluding rural populations and military and institutional residents. | RPI includes the spending patterns of all private households, but, like CPI, excludes the top 4% income households and rural households. |

| Methodology | CPI calculates inflation by taking a sample of goods and services each month, including food, medical care, clothes, consumer electronics, and other items from various locations around a country. | Besides measuring different items, RPI calculation historically uses arithmetic means rather than geometric means, which tends to give a higher rate of inflation than CPI due to a statistical effect known as “formula bias.” |

| Exclusions | It excludes investment items, such as stocks and bonds. | Similar to CPI, RPI excludes investments and savings, but it includes mortgage interest payments and other house ownership costs which CPI does not. |

Historical Trends of Consumer Price Index in India

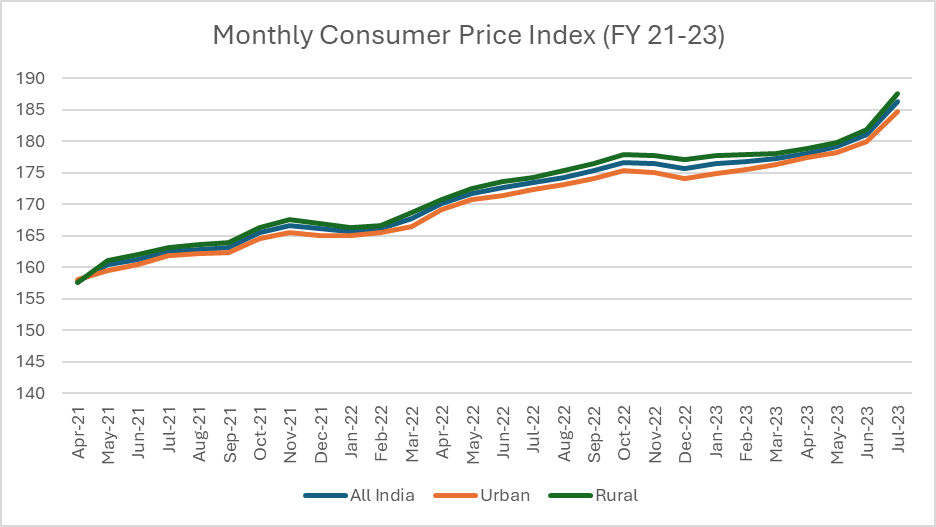

As of July 2023, the aggregate consumer price index for India was 186.3. India’s CPI was higher in rural than in urban areas. Over the course of the recorded time, the rural CPI has continuously outperformed the urban CPI. The Consumer Price Index (CPI) calculates the total shift in prices for goods and services.

Historical Trends of Retail Price Index in India

Over the past decade, India has witnessed significant fluctuations in retail inflation. From a peak of over 10% in 2013 to a record low in early 2017, these trends reflect various domestic and international economic conditions. Factors such as erratic monsoon seasons, fluctuating fuel prices, and changes in fiscal and monetary policies have played pivotal roles. Understanding these trends requires a look at the contributing elements and their interplay over time.

Factors Driving Retail Price in India

Several factors drive inflation in a populous and diverse economy like India:

- Food Prices: Being a major component of the index, food prices heavily influence inflation. Any disruption in agriculture, whether due to weather conditions or pests, can lead to significant price volatility.

- Fuel Costs: India imports a substantial portion of its fuel, making inflation sensitive to global oil prices and exchange rates.

- Government Policies: From tax reforms like GST to subsidies and minimum wage adjustments, government actions have a direct impact on inflation.

Impact of Inflation on Economy and Consumers

Inflation has a twofold impact—on the macroeconomy and on individual consumers. High inflation can erode purchasing power, reduce savings, and deter investment, affecting overall economic growth. For consumers, rising prices mean less disposable income and altered spending behavior, which can slow down economic activity.

Government and RBI’s Role in Managing Inflation

The Reserve Bank of India (RBI) plays a crucial role in managing inflation through its monetary policies, including interest rates and liquidity adjustments. The central bank aims to maintain inflation within a targeted range, using tools such as repo rate adjustments to influence economic activity and stabilize prices. Government fiscal policies also play a supportive role, aiming to balance growth and inflation.

Predictions for Future Inflation Trends

Looking ahead, India’s inflation trajectory will be influenced by global economic recoveries post-pandemic, geopolitical tensions, and domestic policy shifts. Economists suggest a cautious outlook, recommending vigilance and adaptability in policy formulations to manage potential volatility.

Despite price reductions by corporations on the majority of products in the food, personal, and home categories over the last few quarters, consumer goods prices have not decreased from two years ago.

After earlier decreasing, raw material costs are also beginning to exhibit early signals of inflation, suggesting price rises in certain categories may be imminent.

In order to offset rising expenses under categories including raw materials, supply chain, and energy, the majority of consumer products companies raised prices by more than 25% during the last two years.

Consumer Tips for Managing Inflation Impact

Individuals can manage the impact of inflation by:

- Investing Wisely: Diversifying investments to include assets that typically perform well during inflationary periods, such as real estate and stocks.

- Budgeting: Keeping track of expenses and planning for price rises can help maintain financial stability.

- Saving: Building an emergency fund to buffer against inflation shocks is advisable.

Conclusion

As we navigate through fluctuating economic landscapes, understanding the nuances of retail inflation becomes imperative. By closely monitoring inflation and adapting strategies accordingly, both policymakers and consumers can mitigate its adverse effects and steer towards sustainable economic health.