Introduction

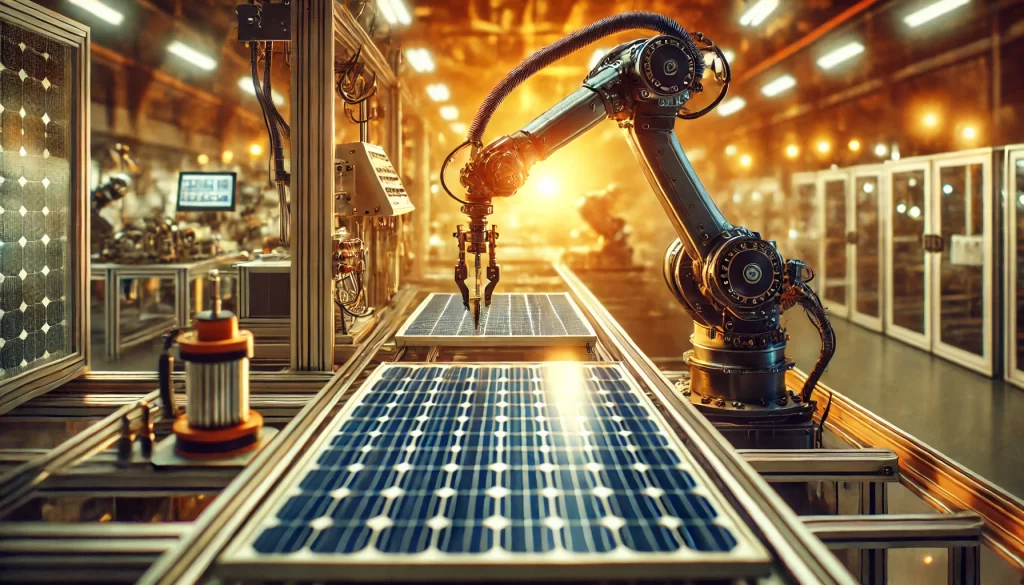

In a strategic move to reduce its reliance on Chinese imports, India is revamping its solar manufacturing industry policies. The country has imposed taxes on specific solar components and introduced an approved list of models and manufacturers. This non-tariff trade barrier aims to curb foreign shipments and foster domestic production. This shift is part of India’s broader strategy to enhance its self-sufficiency in renewable energy, aligning with Prime Minister Narendra Modi’s vision for a more independent and sustainable energy sector.

Key Takeaways

- Domestic Manufacturing Surge: India expects to increase its solar cell-making capacity five-fold by March 2025.

- Import Restrictions: The country is tightening import curbs to boost local adoption of solar power hardware.

- Self-Sufficiency Goal: These measures align with the broader objective of achieving energy independence.

- Global Impact: Similar import restrictions are being observed in the US and Europe to protect local industries.

- Future Plans: India plans to further restrict imports of solar cells, giving the industry time to build domestic capacity.

Boost in Domestic Solar Cell-Making Capacity

India is on the brink of a significant expansion in its solar cell-making capacity. Renewable Energy Secretary Bhupinder Singh Bhalla revealed that the nation’s cell production capacity is set to increase five-fold, reaching approximately 30 gigawatts annually by March 2025. This dramatic increase will enable India to impose stricter import restrictions, which are essential for fostering local production and adoption of solar power hardware. The surge in capacity will help meet Prime Minister Narendra Modi’s ambitious goal of making India more self-reliant in the renewable energy sector.

Strategic Import Restrictions

To achieve this self-sufficiency, India has implemented a series of import restrictions. Taxes have been levied on certain solar components, and a list of approved models and manufacturers has been introduced. These measures are designed to limit foreign imports, primarily from China. By reducing dependence on Chinese products, India aims to create a robust domestic manufacturing ecosystem for solar panels and related hardware. This strategic move is expected to stimulate local production and drive significant growth in the renewable energy sector.

Global Context: US and European Measures

India is not alone in its efforts to counter the dominance of Chinese solar companies. US and European officials have raised concerns about the impact of Chinese solar imports on their domestic industries. The Biden administration recently strengthened tariffs on Chinese solar equipment to protect the burgeoning domestic solar industry. These global measures reflect a broader trend of countries striving to build their own supply chains and reduce reliance on Chinese imports.

Challenges and Future Plans

Despite the progress in domestic module output, Indian manufacturers still depend on China for various back-end products used in making solar panels. To address this, India plans to restrict the import of solar cells next. However, the government will adopt a more cautious approach this time, allowing the industry approximately two years to prepare. This forward-looking policy aims to ensure ample domestic capacity and a smoother transition.

Bhalla emphasized the importance of giving the industry sufficient time to adapt. “We plan to give the industry around two years’ time to prepare so that we have ample domestic capacity,” he said. “It should be a firm, forward-looking policy.”

Industry Adaptation and Demand Concerns

The temporary withdrawal of non-tariff import restrictions on modules last year highlighted the challenges faced by the local industry. Tightening supplies disrupted projects, leading to a pause in policy enforcement. As India continues to push for self-sufficiency, manufacturers are keenly observing domestic demand before committing to new capacities. Rohit Gadre, a BloombergNEF analyst, noted the industry’s cautious stance. “In the absence of adequate local demand, manufacturers will be looking out for strong growth in the export markets for cells and modules made in India,” Gadre said.

Conclusion

India’s strategic shift towards boosting domestic solar manufacturing and reducing reliance on Chinese imports marks a significant milestone in the country’s renewable energy journey. By expanding its solar cell-making capacity and implementing strategic import restrictions, India aims to achieve self-sufficiency in the sector. These efforts align with global trends and Prime Minister Modi’s vision for an independent and sustainable energy future. As the country navigates this transition, the success of these policies will depend on the balance between domestic demand and the growth of export markets.

FAQs

- What is India doing to reduce its reliance on Chinese solar imports?

India has imposed taxes on specific solar components and introduced an approved list of models and manufacturers to curb foreign shipments and foster domestic production.

- How much is India’s solar cell-making capacity expected to increase?

India’s solar cell-making capacity is expected to increase five-fold, reaching about 30 gigawatts annually by March 2025.

- What are the global impacts of India’s solar import restrictions?

India’s measures align with similar actions in the US and Europe, where officials have also imposed tariffs and restrictions to protect their local solar industries from Chinese imports.

- What challenges does India face in achieving solar self-sufficiency?

India still relies on China for various back-end products used in making solar panels. The government plans to give the industry time to build domestic capacity before further restricting imports of these components.

- What is the significance of the approved list of models and manufacturers?

The approved list acts as a non-tariff trade barrier, ensuring that only selected models and manufacturers meet the required standards, thus promoting domestic production and reducing foreign dependence.

Also read: India’s Green Hydrogen Revolution: Leading the Charge for a Sustainable Future