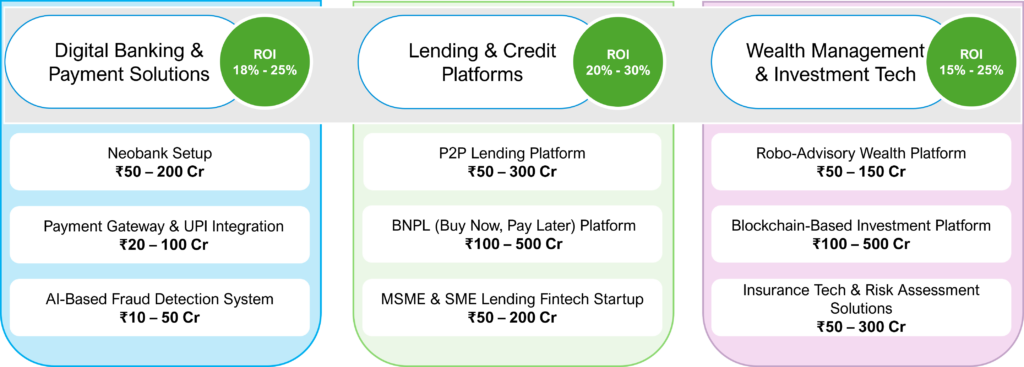

Fintech and Financial Services Opportunity Landscape

Market Overview and Growth Potential

India’s financial technology growth is being supported by improving digital adoption across consumers and small businesses, including higher smartphone usage, increased comfort with app-based services, and wider merchant acceptance of digital payments. This is creating a larger addressable base for financial technology solutions, beyond metro cities, particularly in Tier 2 and Tier 3 markets where conventional financial access historically remained limited.

Another important driver is the rapid evolution of customer expectations. Users increasingly seek faster credit decisions, simplified onboarding, transparent pricing, and integrated experiences across payments, credit, savings, and insurance. This shift has created room for new business models such as embedded finance, co-lending, and fintech-led distribution partnerships with regulated institutions.

India’s financial service and fintech sector is expanding rapidly, driven by digital transformation, increased financial inclusion, and government-backed initiatives. The Union Budget 2025-26 emphasizes:

- Expansion of digital banking and financial technology innovations

- Strengthening of financial infrastructure and credit accessibility

- Growth of payment ecosystems and lending platforms

Key Market Indicators:

Market indicators should be interpreted as directional signals rather than precise forecasts, since different reports use varying definitions for “fintech market size” and different measurement bases such as revenue pools, transaction value, ecosystem valuation, or funding activity. However, the underlying trend remains consistent across sources: the sector continues to deepen, diversify, and institutionalise across multiple product categories.

Further, while payments remains a high-volume segment, value creation is increasingly shifting toward credit enablement, risk and fraud analytics, B2B fintech infrastructure, and specialised platforms that serve MSMEs. For new entrants, the strategic focus typically needs to move beyond “scale at any cost” and instead build a clear advantage in customer acquisition economics, underwriting performance, and regulatory-grade governance.

- India’s fintech market projected to reach $150 billion by 2030

- Digital payments expected to grow at 22% CAGR

- ₹10,000 crore allocated for financial inclusion and digital infrastructure

- Rising adoption of blockchain, AI, and machine learning in fintech

Government Policies and Budgetary Support

Government policy support tends to have the strongest impact when it reduces friction for customer onboarding, enables faster credit flow, and strengthens the trust architecture around digital transactions. In fintech, policy support is often indirect, through improvements in digital infrastructure, identity systems, payments rails, and institutional mechanisms that increase formal financial participation.

Budget 2025-26 Incentives:

- ₹10,000 crore allocation for fintech infrastructure development

- Tax exemptions for digital lending startups and payment firms

- PLI incentives for AI-driven financial analytics and security

- Increased regulatory support for blockchain-based transactions

From a business opportunity perspective, budgetary direction and regulatory intent matter because they influence three feasibility determinants: speed to market (through approvals and compliance expectations), cost to serve (through digital rails and data access mechanisms), and risk exposure (through evolving consumer protection and cybersecurity expectations). A feasibility study typically evaluates how policy and regulatory direction will shape product design, compliance processes, and go-to-market choices over the next 3–5 years.

Key Challenges and Risks

Cybersecurity and data protection are not merely compliance items. They are business continuity and reputation risks. A single incident can trigger customer churn, partner restrictions, regulatory scrutiny, and potentially significant remediation costs. Therefore, feasibility assessments should explicitly incorporate security-by-design, periodic audits, incident response readiness, and vendor risk controls, particularly when fintech platforms rely on third-party service providers and cloud infrastructure.

Competition risk also needs a practical interpretation. In several segments, customer acquisition costs can rise sharply, and price-led competition can compress margins. In such environments, sustainable differentiation typically comes from distribution partnerships, superior underwriting and risk pricing, niche customer targeting, or unique product bundling rather than replicating broadly available payment or lending features.

- Cybersecurity and data protection regulations

- High competition and market saturation in payment solutions

- Regulatory uncertainties in lending and investment sectors

- Rising concerns over digital fraud and financial scams

Implementation Roadmap

Short-Term (0-2 Years)

- Develop a scalable fintech platform with compliance-ready infrastructure

- Secure seed funding and government grants for fintech innovation

- Establish key partnerships with banks, NBFCs, and payment networks

Medium-Term (2-5 Years)

- Expand market reach and onboard new users with innovative solutions

- Scale AI and blockchain-based security for enhanced transaction safety

- Enhance financial literacy programs and user engagement strategies

Long-Term (5+ Years)

- Position India as a global fintech innovation hub

- Integrate advanced AI and deep tech for hyper-personalized financial solutions

- Strengthen cross-border digital payment frameworks

Conclusion

India’s financial service and fintech sector presents high-growth, technology-driven investment opportunities. With strong regulatory support, evolving market demand, and advancements in digital financial solutions, businesses can build scalable, profitable ventures in fintech, digital lending, and wealth management.

Reach out to us by filling the form to get a project report / feasibility study done to start a business in this sector.