The global auto industry is no stranger to supply chain shocks. From semiconductor shortages to pandemic-induced factory shutdowns, automakers have weathered some serious storms in the past five years. But just as the dust seemed to settle, another crisis has emerged – this time, involving the obscure but essential rare-earth magnets, largely sourced from China.

Rare-earth magnets might not be the stuff of headlines, but they are hidden inside nearly every car component that moves or senses something, from mirrors to motors. With China imposing export curbs on these critical materials, automakers across Europe, the U.S., and India are bracing for a serious disruption. From panicked calls to magnet suppliers to hurried trade talks and whispered government lobbying, it’s clear: the industry’s old supply chain vulnerabilities are back to haunt it, and this time, the stakes might be even higher.

Key Takeaways

- Rare-earth magnets are critical to modern vehicle functions, especially in EVs.

- China dominates rare-earth mining, refining, and magnet production, creating a global supply bottleneck.

- Automakers are scrambling to stockpile magnets and explore alternatives to prevent shutdowns.

- India is highly vulnerable, being 100% import-dependent on critical rare-earth materials.

- Innovation and recycling offer long-term solutions, but most efforts are not yet scalable.

The Global Auto Industry’s Rare-Earth Magnet Dependency

Why Rare Earth Magnets Are Crucial for Modern Vehicles

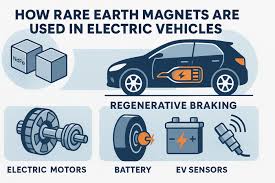

Rare-earth magnets power the silent revolution behind the scenes of automotive engineering. These powerful magnets are made from elements like neodymium, dysprosium, and terbium, and are crucial for components such as electric motors, power steering systems, fuel sensors, and braking assist technologies. EVs in particular are magnet-hungry, using around 0.5 kg of rare-earth elements per vehicle, twice as much as fossil-fuel cars.

With vehicles becoming increasingly software-defined and hardware-rich, rare-earth magnets are not just useful – they’re essential. Whether it’s the motor in an electric vehicle (EV), the sensors enabling advanced driver assistance systems (ADAS), or simply high-performance stereo speakers, these magnets make things tick. Unfortunately, they’re not easily replaceable, which makes the industry’s reliance on them a serious vulnerability.

China’s Dominance and Strategic Leverage

Here’s where things get tricky: China isn’t just a large player – it’s the player. It controls about 70% of rare-earth mining, 85% of refining, and 90% of magnet production. That means automakers’ assembly lines – be it in Stuttgart or Pune – are essentially beholden to Beijing’s export policies.

And China knows it. From a 2010 dispute with Japan to the current curbs affecting the U.S. and India, Beijing has used rare-earths as an economic and geopolitical card. The latest restrictions have left dozens of companies scrambling for export permits, with applications piling up in Chinese bureaucratic offices. For many automakers, a small group of officials in China now decides whether their factories stay open or idle.

A Supply Chain on the Brink: Worldwide Fallout

Factory Shutdowns and Emergency Stockpiling

Frank Eckard, CEO of Germany-based Magnosphere, says he’s been overwhelmed with desperate calls from automakers and suppliers alike. “They are willing to pay any price,” he notes – a stark sign of panic among manufacturers. Some have reported that if magnet supplies don’t materialize soon, production lines could shut down by mid-July.

Companies are stockpiling magnets at any cost, while others are considering halting production of feature-rich models to conserve limited resources. It’s déjà vu all over again similar to the semiconductor crisis, which forced automakers to deliver cars minus chips, only to retrofit them months later.

Lessons Not Learned from Previous Crisis

The semiconductor shortage and pandemic disruptions were supposed to be wake-up calls. Supply chain diversification became a boardroom buzzword. Just-in-time inventory strategies were re-evaluated. Yet, according to Eckard, “nobody has learned from the past.” Many OEMs and Tier-1 suppliers are still operating without sufficient buffer stock or backup plans.

The rare-earth crunch is a brutal reminder that reactive planning is no match for proactive supply chain resilience. With factories already halting in Europe and risks mounting in North America and Asia, the auto industry is once again in firefighting mode.

How Automakers Are Reacting to the Magnet Crisis

OEMs and Suppliers Scrambling for Alternatives

OEMs like BMW, General Motors, and Mercedes-Benz are currently engaged in supplier audits to determine exposure to rare earths. They are also exploring ways to build short-term stockpiles and prioritize magnet allocation to critical components.

Auto suppliers like Aptiv and BorgWarner are digging deep into their vendor lists, trying to figure out which sub-suppliers need export licenses. Meanwhile, the U.S. and China are back at the negotiation table, with trade talks expected to address the magnet crisis specifically. But these discussions take time, and time is exactly what the industry doesn’t have.

Rare-Earth-Free Innovations and Recycling Efforts

In a race against time, some companies are investing in rare-earth-free alternatives. Niron Magnetics, a U.S. startup, has developed magnets using iron nitride instead of rare earths and has raised $250 million from investors like GM and Stellantis. A full-scale $1 billion production facility is planned for 2029 – great news for the future, not so much for 2025.

Meanwhile, recycling initiatives are gaining momentum. German specialist Heraeus has started magnet recycling but warns it’s operating at just 1% capacity. Without government incentives or large-volume buyers, these efforts may fizzle out before scaling up.

The Role of Diplomacy and Trade Negotiations

Governments are finally paying attention. The EU has fast-tracked the Critical Raw Materials Act to boost local sourcing. The U.S. is negotiating for exemptions, and India has begun lobbying for immediate relief and longer-term mining investments.

But policy moves take time to implement, and export license rejections from China keep piling up. Diplomatic channels may provide short-term breathing room, but a structural solution is still years away.

India’s Rare-Earth Reliance: A Growing Concern

Why India Is Especially Vulnerable

India is 100% import-dependent for most critical minerals, including rare-earths. Despite having reserves, it lacks the mining, refining, and manufacturing infrastructure needed to compete globally. As a result, it imported about 460 tonnes of rare-earth magnets in FY24 – a number expected to jump to 700 tonnes in FY25 due to rising EV adoption.

With China’s export curbs in full effect, India’s domestic auto sector, particularly EVs, is feeling the heat. If supply disruptions persist, automakers could face shutdowns as early as July or August 2025.

Impact on EVs and Feature-Rich Vehicle Production

EVs are particularly exposed, with over 70% of electric motors in India using Permanent Magnet Synchronous Motors (PMSMs). The higher the trim level, the more rare-earths are used for motors, infotainment systems, sensors, and more. This means feature-rich vehicles could vanish from showrooms if supply chains don’t stabilize soon.

Companies like Vayve Mobility, known for their compact EVs, are already raising red flags. With limited domestic production of rare-earths, and nearly no local magnet manufacturing, the Indian auto industry is cornered.

Can India Build a Self-Reliant Rare-Earth Ecosystem?

Government Initiatives and Industry Lobbying

There’s growing consensus among industry leaders that India must act fast. Lobbying is underway to classify rare-earths as “strategic materials” and boost domestic extraction and refining. The government is exploring public-private partnerships and inviting foreign players to invest in Indian mineral projects.

Initiatives like the Critical Minerals Mission and partnerships with countries like Australia could help in the long run. However, building refining capacity and magnet manufacturing infrastructure is a multi-year process.

Long-Term Plans vs. Short-Term Crisis Management

While the long-term goal is self-reliance, immediate fixes are still needed. Ideas range from diplomatic negotiations to fast-tracking recycling and investing in alternative magnet technologies. However, these band-aids can only do so much.

In the meantime, automakers must triage – delaying launches, reducing features, or pausing production. As seen during the semiconductor crunch, these short-term strategies hurt margins and delay recovery. Unless India accelerates both its crisis response and long-term plans, the auto industry may find itself stuck in a perpetual cycle of disruption.

Conclusion

The rare-earth magnet crisis has hit the global automotive industry at a precarious time. Just as carmakers were recovering from chip shortages and pandemic disruptions, they now face a bottleneck that strikes at the heart of modern vehicle manufacturing. China’s dominance over the rare-earth supply chain leaves little room for error, and the race for alternatives has only just begun.

For India, the situation is even more urgent. With zero domestic manufacturing of critical magnets and heavy reliance on Chinese imports, the country’s ambitious EV and auto goals are at serious risk. To move forward, industry and government must act in unison – investing in domestic capabilities, diversifying sources, and building a truly resilient ecosystem. Otherwise, the next crisis may not be a question of if, but when.

Credits: Economic Times, Hindustan Times

Also read: Project Report for EV Charging Station and Battery Recycling Businesses