To serve as a single point of contact for the approval of requests to establish Inland Container Depots (ICDs), Container Freight Stations (CFSs), and Air Freight Stations (AFSs), an Inter-Ministerial Committee (IMC) was established in 1992. The guidelines issued by the Ministry of Commerce and Industry in 1992 set forth the conditions for establishing ICDs and CFSs. The Central Board of Indirect Taxes (CBIC) was given jurisdiction over the issues pertaining to the establishment of ICDs, CFSs, and AFSs in 2018.

The cargo volumes and capacity of ICDs, AFSs, and CFSs have multiplied over the past 20 years. The operations of import and export logistics have undergone a complete transformation because of a few significant efforts that have changed the nature of commerce in recent years. Like how expressways and national highways that connect ports to the hinterland have exponentially improved physical infrastructure. On the country’s Western and Eastern shores, numerous new private ports and terminals have been built inside of already-existing ports. The operationalization of Western and Eastern Dedicated Freight Corridors soon is expected to completely change the dynamics of cargo movements.

WHAT IS AN INLAND CONTAINER DEPOTS (ICD)?

An ICD or a dry port is an off-seaport container storage facility primarily located in the northern hinterlands, far from any significant ports. Before and after transferring their containers through ports, several shipping companies store their containers in ICDs. ICDs have excellent rail and road connections to ports.

It is a facility that has fixed installations that provide services for handling, and clearance of laden import, and export containers under customs control and with storage facility for customs bonded or non-bonded cargo. It is also called dry ports as they act as a hub for loading and unloading cargo and containers in a multi-modal transport logistics system.

WHAT IS A CONTAINER FREIGHT STATION (CFS)?

CFSs are generally located near ports or terminals or near a major railway hub. They can be privately owned or owned by the shipping companies. CFSs are majorly found in centralized locations where the exporters and importers can Consolidate the container by stuffing their Less than Container Load (LCL) to form a Full Container Load (FCL) or De-Consolidate the container, and vice versa.

It is a place where imports and exports are stored temporarily. It was designed with the intention of reducing congestion at India’s ports and terminals. It is an extension of a port or terminal. At present, the majority of CFSs are located up to 50 Km away from the port and are concentrated in high numbers in western and southern India.

WHAT IS AN AIR FREIGHT STATION (AFS)?

The Air Freight Station (AFS) is an off-terminal facility or an extension of the airport where all import/export formalities could be handled easily for cargo transportation. AFSs are constructed with the intention of strengthening the nation’s air cargo transportation infrastructure. In addition to decongesting the crowded air cargo terminals in several gateway international airports that confront excessive dwell times, the initiative of AFS was taken to establish an enabling environment for promoting international air cargo operations.

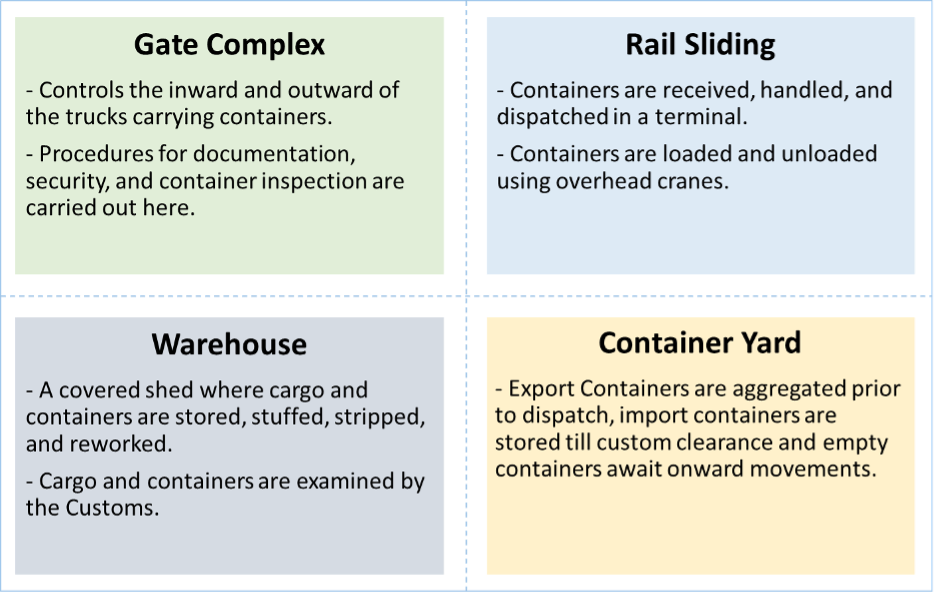

WHAT ARE THE IMPORTANT CENTERS OF ACTIVITIES RELATING TO ICD / CFS?

WHAT ARE THE CRITERIA FOR SETTING UP A NEW ICD / CFS?

Geographical Criteria:

- The geography of the country has been divided into three types for the purpose of opening of new ICD / CFS.

- Green Zone: This includes states that have less ICD / CFS. These will be open for proposals for the States of Himachal Pradesh, Bihar, Jharkhand, West Bengal, Sikkim, Assam, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, and Telangana as well as Union Territories of Jammu and Kashmir and Ladakh.

- Blue Zone: States for which proposals will be accepted if it is for specific trade-generating locations with no existing facilities or with over-utilized facilities. States like Uttarakhand, Uttar Pradesh, Chhattisgarh, Odisha, Andhra Pradesh, Goa, Karnataka, and Kerela as well as the Union Territories of Puducherry, and Diu and Daman.

- Red Zone: The states where adequate ICD / CFS infrastructure is available. These states are closed for any new ICD / CFS development indefinitely.

- The distance of ICD from the connecting seaport should not be less than 200 km and the distance between ICD and railways should be more than 1500 km.

- The distance between two different ICDs should be more than 100 km in both directions.

- Identifying and promoting the development of ICD / CFS / AFS in states with low logistics infrastructure is given the utmost priority.

- The approval and notification of all new ICD / CFS, including existing and new MMLPs, will be processed in consonance with the national logistics action plan/policy.

- Development of ICDs based on Inland National waterways as a mode of transportation will be encouraged with relaxation being given on Geographical Zone and Distance rules.

- Only one greenfield ICD directly linked with Dedicated Freight Corridors (DFCs) will be accorded within 100 km in both directions.

- Exceptions: IMC can approve the creation of additional facilities near existing ICDs (all 3 zones) if the demand exceeds the existing capacity of ICDs / CFSs in trade-generating locations. Also, no new CFS shall be set up which is linked to an ICD. Only CFSs connected to ports in the permissible zones shall be allowed after considering existing capacity and utilization parameters.

| ICD | CFS | AFS | |

| LOCATION | Located in the Hinterland. | Located near Off Seaports. | Located near Off Airports. |

| FUNCTIONS | Receipt and dispatch of cargo, stuffing, and stripping of containers. It is a self-contained Customs Station. | Receipt and dispatch of cargo, stuffing, and stripping of containers. It cannot have independent existence and must be linked to a Customs Station. | Facility equipped with fixed installations of minimum requirements and offering services for handling and temporary storage of import and export cargo. |

| LAND | Minimum 7 Hectares of land. | Minimum 2 Hectares of covered land. | Minimum 0.2 Hectares of land for imports and exports. |

| VOLUME | Minimum threshold performance shall be 7200 consignments per year (2 ways). | Minimum threshold performance shall be 1200 consignments per year (2 ways). | No minimum threshold performance is prescribed for an AFS. |

Other Criteria:

- Legal Entity: The applicant must be a legal entity in India under applicable law. The entity must possess a valid GST registration and should have been operating for a minimum period of three years.

- Prior experience: The applicant must have prior experience operating as Certified Cargo Screening Program (CCSP) or should have other trans-border logistics experience such as a logistics service provider including customs brokers, transporters, freight forwarders, shipping lines, and port terminal operators.

WHAT IS THE PROCEDURE TO APPLY FOR ICD / CFS?

The contents of the article are taken from the Policy and Guidelines for setting up Inland Container Depot (ICDs), Container Freight Stations (CFSs), and Air Freight Stations (AFSs).

Also Read: Comprehensive Guidelines for Customs Cargo Service Providers (CCSPs) Under the Customs Act, 1962