The India UK Free Trade Agreement (FTA), signed on July 24, 2025, by Prime Minister Narendra Modi and his UK counterpart Keir Starmer, is a landmark economic accord that redefines bilateral trade relations between two of the world’s most dynamic democracies. As India’s first major FTA in over a decade and one of the UK’s most consequential post-Brexit trade pacts, this agreement goes far beyond tariff reduction, paving the way for collaborative growth, sustainable development, and global competitiveness.

Aimed at increasing bilateral trade by £25.5 billion (US$34.5 billion) annually and doubling overall trade to US$120 billion by 2030, the deal opens up immense possibilities across various sectors. For Indian businesses from MSMEs and manufacturers to service providers and startups, the FTA unlocks the door to new markets, reduced costs, and powerful global alliances.

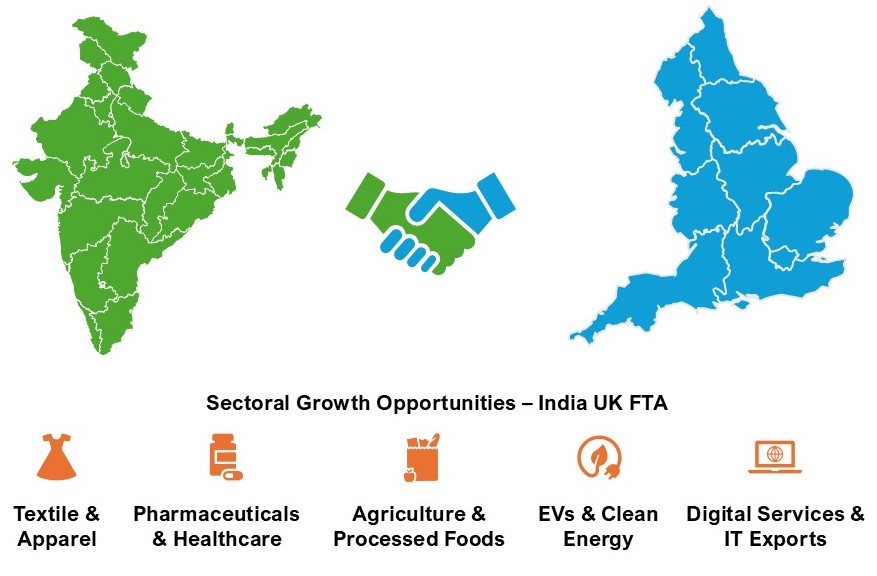

Expanding Sectoral Opportunities: Key Industries Poised for Growth

Textiles and Apparel: India’s Edge in Ethical Fashion

The elimination of tariffs on Indian exports of garments, leather, and footwear to the UK is set to significantly enhance the global competitiveness of manufacturing clusters in Tirupur, Surat, and Ludhiana. With increasing demand in the UK for sustainably produced and ethically sourced fashion, Indian exporters have a unique opportunity to differentiate themselves by offering products made from organic cotton, eco-friendly dyes, and traditional artisanal techniques.

Indian fashion brands are already expanding their global footprint, and with relaxed UK import duties, new entrants can now explore direct-to-retail and online marketplace strategies in Britain.

Expansion Strategy:

- Collaborate with UK high-street brands as supply partners

- Use e-commerce to directly target British consumers

- Certify sustainability and fair-trade credentials to appeal to UK buyers

Pharmaceuticals and Healthcare: Fast-Tracking Access

India’s pharmaceutical industry, already a $50 billion sector, stands to benefit immensely from easier regulatory pathways and recognition of Good Manufacturing Practices (GMP). Indian pharma companies can now introduce generics, biosimilars, and herbal remedies to the UK market with fewer bureaucratic hurdles.

This aligns well with the National Health Service (NHS’s) increasing demand for cost-effective medication and specialized treatments.

Expansion Strategy:

- Establish or acquire distribution networks within the UK

- Co-develop products with UK biotech startups

- Leverage the FTA to access EU markets via UK channels

Agriculture and Processed Foods: From Fields to Foreign Shelves

Indian agribusinesses will benefit from duty-free treatment on 95% of agricultural tariff lines. Products like basmati rice, tea, spices, seafood, and processed foods are expected to see a major uptick in demand from the UK market.

Moreover, the FTA simplifies compliance with sanitary and phytosanitary (SPS) measures, making it easier for Indian exporters to meet UK food safety standards. Indian brands can now expand their packaged food portfolios in the UK’s multicultural supermarkets and ethnic food stores.

Expansion Strategy:

- Enhance branding and packaging to suit UK regulations

- Obtain Geographical Indication (GI) status for niche exports

- Partner with UK food chains for product placement and distribution

EVs and Clean Energy: A Green Investment Corridor

The UK’s goal of becoming a net-zero economy by 2050 complements India’s ambitions in electric mobility and renewable energy. The FTA facilitates capital flow, technical collaboration, and procurement opportunities in sectors like solar energy, battery storage, hydrogen fuel, and EV charging infrastructure.

Indian companies can now engage in joint ventures and green bond funding with UK firms. In return, British green tech innovators gain access to one of the world’s largest renewable energy markets.

Expansion Strategy:

- Bid for UK government green infrastructure projects

- Import British EV components duty-free and assemble locally

- Leverage Indian talent and R&D for low-cost, high-performance clean tech

Digital Services and IT Exports: Fuelling Knowledge Economy

India’s IT and digital services exports, valued at over $180 billion, will gain further momentum as the FTA liberalizes digital trade. It introduces provisions for paperless customs, electronic documentation, non-disclosure of source code, and streamlined service export channels.

Indian IT giants along with smaller SaaS startups can now scale their UK operations without facing excessive red tape. Furthermore, the mutual recognition of professional qualifications will ease staffing challenges in the tech sector.

Expansion Strategy:

- Scale software development centres for UK clients

- Offer specialized services in AI, cybersecurity, and data analytics

- Use the UK as a base to enter the European tech market

Strengthening MSMEs and Local Ecosystems

The FTA is a game-changer for India’s 63 million micro, small, and medium enterprises (MSMEs), which often lack the resources to navigate complex international regulations. With relaxed customs procedures, simplified documentation, and a reduced cost of compliance, MSMEs across regions like Maharashtra, Gujarat, West Bengal, and Tamil Nadu can now access the UK market directly.

Clusters producing handicrafts, leather goods, ayurvedic products, and light engineering goods are particularly well-positioned to benefit. The government is expected to launch FTA-focused awareness programs and digital portals to help MSMEs tap into these opportunities.

Boosting Mobility and Human Capital Exports

The agreement includes significant provisions for professional mobility, easing visa restrictions for skilled Indian professionals. It removes the requirement for double social security contributions and facilitates temporary movement of IT professionals, consultants, engineers, and financial service experts.

Sectors like healthcare, fintech, and consulting, where the UK faces talent shortages, will now increasingly rely on India’s vast pool of skilled professionals. This not only promotes employment but also enables Indian companies to reduce their international HR costs.

Key Gains:

- Mutual recognition of engineering and financial qualifications

- 3-year visas for intra-corporate transferees without social security deductions

- Increased role for Indian HR, staffing, and placement firms

Government Procurement: Unlocked for UK Firms, Strategic for Indian Partners

For the first time, UK companies meeting a 20% domestic sourcing requirement will be treated as “Class II” suppliers in India’s public procurement ecosystem. This opens up INR 4 trillion (US$46.3 billion) worth of government tenders in infrastructure, defense, smart cities, and public services.

Indian businesses can capitalize by becoming subcontractors or joint venture partners for UK bidders, especially in sectors like renewable energy, smart logistics, and digital public infrastructure.

Investment Flows and Market Access: Building Stronger Economic Ties

The UK government anticipates £6 billion in investments and the creation of 2,200 jobs directly linked to the FTA. India’s export-driven businesses will expand operations, hire locally, and forge new alliances in the UK.

Indian conglomerates in sectors like automobiles, chemicals, and fast-moving consumer goods (FMCG) will benefit from lower entry barriers and increased consumer access.

Meanwhile, British brands, particularly in premium spirits, luxury cars, cosmetics, and education, can now enter or expand in India with reduced tariffs and compliance friction.

A Bilateral Snapshot: The India UK Trade Landscape

| Fiscal Year | Exports from India (USD Mn) | Imports to India (USD Mn) | Total Trade (USD Mn) | Surplus (USD Mn) |

| 2022–23 | 11,458 | 8,961 | 20,419 | 2,497 |

| 2023–24 | 12,982 | 8,414 | 21,396 | 4,568 |

| 2024–25 | 14,550 | 8,607 | 23,157 | 5,943 |

| 2025–26* | 2,172 (Q1) | 1,394 (Q1) | 3,566 | 778 |

*Provisional for April–June 2025

India’s consistent trade surplus and growing export volumes underline its strong competitive position. The FTA is expected to further widen this gap in India’s favor, especially in value-added sectors.

Conclusion: Turning Policy into Prosperity

The India UK Free Trade Agreement 2025 is not merely a diplomatic win it is a blueprint for long-term, inclusive economic transformation. It expands opportunities for exporters, investors, and service providers while deepening regulatory alignment and institutional cooperation.

Indian businesses must act now: identify eligible product lines, align internal systems with UK requirements, and invest in market intelligence and digital capabilities. Whether it’s a tech startup in Bengaluru, a textile unit in Coimbatore, or a logistics firm in Mumbai, every enterprise has a role in this next phase of India UK cooperation.

With strategic vision and coordinated action, the FTA can catalyze an era where Indian enterprise becomes a central pillar of global trade.

Looking to explore business opportunities, feasibility studies, or investment advisory services? We provide expert guidance on navigating and unlocking growth potential.

Contact us today to explore strategic opportunities in the India UK Free Trade Agreement.