India’s Production Linked Incentive (PLI) schemes represent a bold and transformative initiative aimed at making the nation a global manufacturing hub. Launched in 2020 and progressively expanded, these schemes focus on boosting domestic production, attracting investments, and reducing import dependency. With a financial allocation exceeding ₹2 lakh crore, PLI schemes encompass a wide range of sectors, including electronics, automobiles, pharmaceuticals, and renewable energy, among others.

While these initiatives promise long-term benefits, they also raise a pertinent question: Are PLI schemes the sustainable growth engines India needs, or do they risk creating short-term economic bubbles? This analysis explores the potential, challenges, and implications of PLI schemes, supported by sector-specific examples and data insights.

Understanding PLI Schemes: A Strategic Framework

PLI scheme aim to enhance manufacturing by linking subsidies to measurable performance metrics such as production output and infrastructure investment. The primary objectives include:

- Expanding manufacturing capacity in critical and emerging industries.

- Enhancing export capabilities to position India as a global leader in manufacturing.

- Reducing dependence on imports, especially in essential product categories.

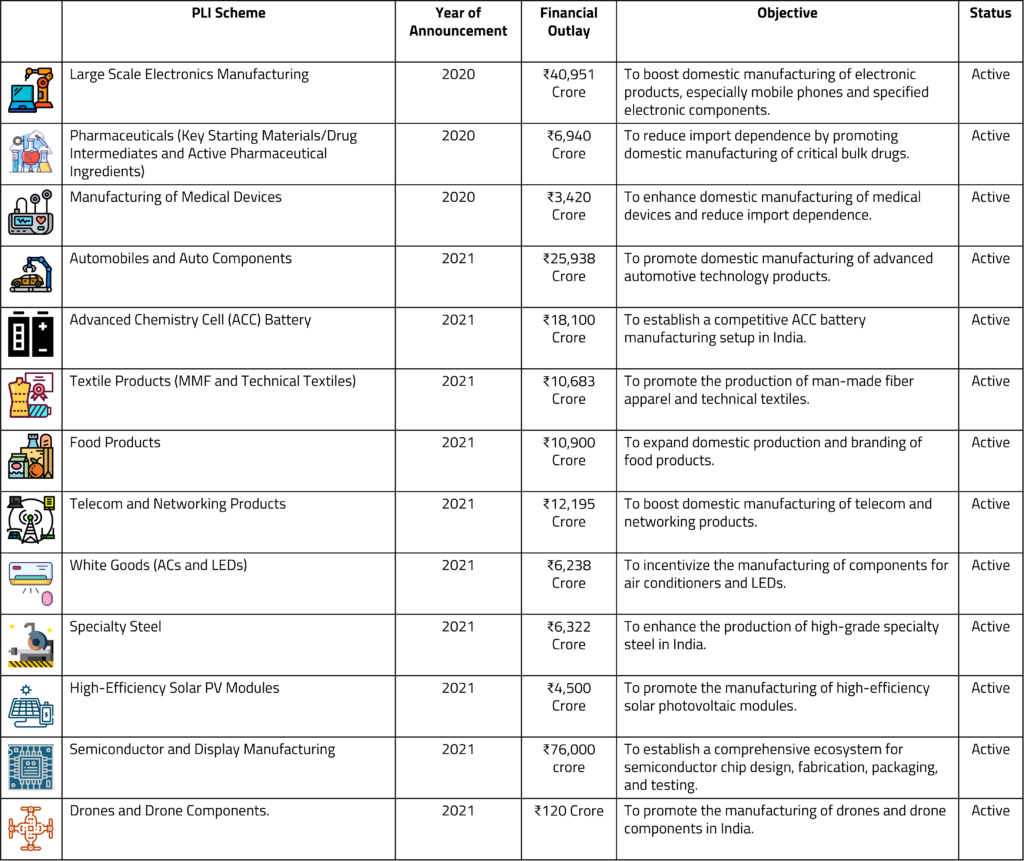

List of Existing Production Linked Incentive Scheme

Below is a list of schemes along with their financial outlay and objective. The schemes below are currently active and continue to attract applications from domestic manufacturers. Several projects have already commenced production under these initiatives.

Impact of Key PLI Schemes

Electronics Manufacturing:

Mobile Phones and Components:

With a financial outlay of ₹40,951 crore, the electronics PLI scheme has catalyzed a remarkable transformation in the electronics industry. India’s mobile phone exports crossed the $10 billion mark in FY23, showcasing significant growth. Companies such as Apple and Samsung have expanded operations, driving job creation and technology transfer. The rise in domestic production has also stimulated ancillary industries like packaging, logistics, and retail.

Semiconductors and Chip Manufacturing:

The ₹76,000 crore semiconductor PLI aims to address India’s heavy reliance on chip imports, a critical component in electronics and automobiles. This initiative is set to reduce vulnerabilities exposed by global supply chain disruptions during the COVID-19 pandemic.

Pharmaceuticals:

The ₹6,940 crore PLI for Active Pharmaceutical Ingredients (APIs) has significantly reduced India’s reliance on Chinese imports for key drug components. Domestic API production has surged, enabling uninterrupted drug manufacturing, even during crises.

Automobiles and Electric Vehicles (EVs):

With a financial commitment of ₹25,938 crore, the automobile PLI has driven investments in EV production, including advanced battery technologies. India has witnessed a 25% year-over-year growth in EV adoption, contributing to reduced carbon emissions and greater energy independence. Battery manufacturing facilities and charging infrastructure have also expanded, creating a robust ecosystem.

The Promise of Long-Term Benefits

Strengthening Domestic Manufacturing:

PLI schemes aim to fortify supply chains and enhance self-reliance under the Atmanirbhar Bharat initiative. The ₹76,000 crore semiconductor PLI, for instance, seeks to establish domestic chip manufacturing, reducing India’s dependence on imports for semiconductors. Similarly, the pharmaceutical PLI has addressed vulnerabilities highlighted during the pandemic by boosting domestic API production.

Enhancing Export Competitiveness:

PLI initiatives incentivize production for export markets, helping India compete globally. The textile PLI, with a ₹10,683 crore allocation, has increased exports of man-made fibers and technical textiles by 20%.

Job Creation:

PLI schemes have created substantial employment opportunities. For example, the ₹19,500 crore solar PV module PLI has tripled domestic production capacity and generated numerous manufacturing and assembly jobs.

Facilitating the Green Energy Transition:

The ₹17,490 crore allocation for green hydrogen and solar PV modules aligns with India’s decarbonization goals, promoting renewable energy technologies that deliver environmental and economic benefits.

The Risks: Are Short-Term Bubbles Forming?

Subsidy Dependency:

Over-reliance on subsidies could hinder long-term sustainability. The solar PV module sector, for example, faces stiff competition from cheaper Chinese imports, raising concerns about viability beyond government incentives.

Execution Challenges:

Delays in fund disbursement and bureaucratic inefficiencies could diminish the effectiveness of these schemes. In the telecom sector, for instance, despite a ₹12,195 crore allocation, approval delays have slowed the development of domestic manufacturing for 5G and networking equipment.

Overcapacity Risks:

Excessive production driven by subsidies may lead to overcapacity. In industries like steel and textiles, this can result in idle production facilities and financial strain if global demand does not align with increased output.

Sectoral Imbalances:

Focusing on specific sectors risks neglecting traditional manufacturing industries not covered by PLI incentives, potentially leading to uneven industrial growth.

Complementary Schemes: Addressing Gaps

While PLI schemes target supply-side growth, complementary initiatives like FAME (Faster Adoption and Manufacturing of Electric Vehicles) address demand-side challenges. For example:

- EV and Battery PLI (₹25,938 crore): Supports domestic EV component production.

- FAME Phase II (₹10,000 crore): Offers subsidies to encourage EV adoption.

Together, these programs create a comprehensive ecosystem to address both supply and demand challenges.

Strategies for Sustainable Implementation

To ensure long-term success, PLI scheme must focus on:

- Building Comprehensive Ecosystems: Developing end-to-end value chains is crucial. For example, the semiconductor PLI must also address upstream and downstream requirements like chip packaging and testing facilities.

- Phasing Out Subsidies: A well-defined exit strategy is essential to prepare industries for global competitiveness without reliance on government support.

- Encouraging Innovation: Incentives for research and development (R&D) are vital. Expanding the automobile PLI to include advanced battery technologies and autonomous vehicles can future proof the sector.

- Monitoring and Accountability: Strong monitoring mechanisms are needed to track the utilization of funds and ensure alignment with long-term objectives.

Conclusion: Growth Engines or Short-Term Bubbles?

India’s Production Linked Incentive schemes hold immense potential to reshape industries and accelerate economic growth. Success stories in electronics, pharmaceuticals, and EV production demonstrate their ability to create jobs, reduce import dependency, and enhance export competitiveness. However, challenges like subsidy dependency, inefficiencies in execution, and the risk of overproduction need to be addressed.

PLI schemes can become sustainable growth engines by fostering ecosystem development, encouraging innovation, and focusing on global competitiveness. Without these measures, they may risk falling short of their transformative potential, leaving behind unsustainable, subsidy-driven industries.

Read More about the Production Linked Incentive Schemes