Introduction

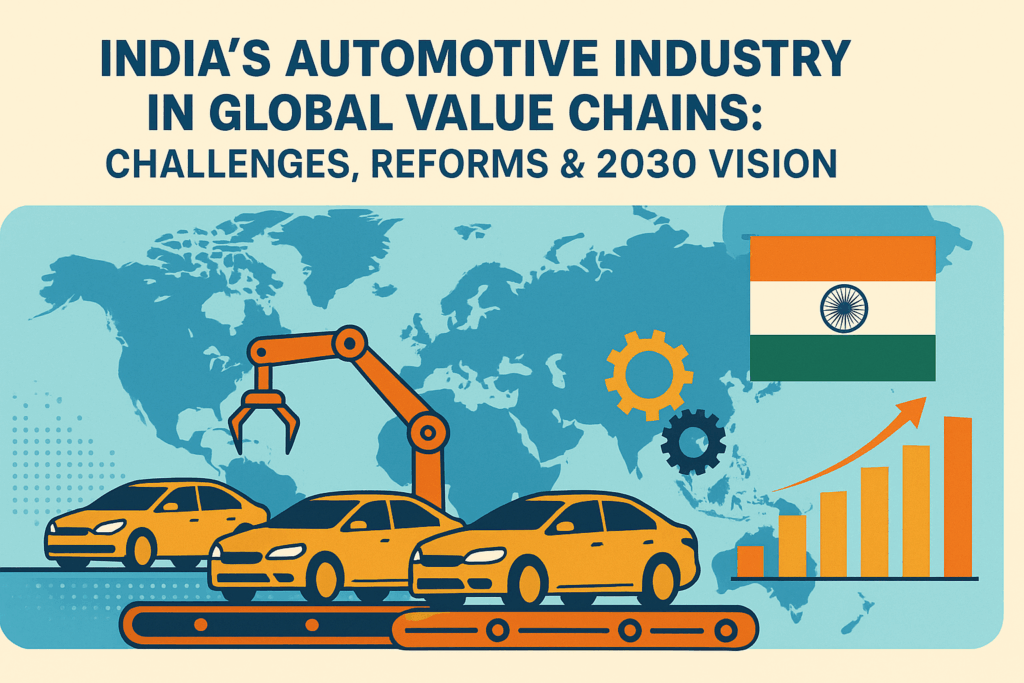

India’s automotive industry is hitting the accelerator on transformation. A recent April 2025 report by NITI Aayog, developed with CRISIL, makes it clear—India’s time to shine in the global automotive value chain has arrived. While the country holds the impressive title of the world’s fourth-largest automobile producer, its global auto component market share is just 3%. That’s surprisingly low, especially given its production capacity, labor cost edge, and growing policy support. The report sets a bold target: $145 billion in component production and $60 billion in exports by 2030, with a trade surplus of $25 billion.

The global auto game has changed drastically over the last century—from Ford’s assembly lines to today’s AI-driven, electric, and autonomous vehicles. Countries like China, Germany, and South Korea have already shifted gears. India’s automotive sector, though robust at home with 28 million vehicles produced in FY 2023–24, must evolve to stay competitive globally. And honestly? It’s not just about catching up anymore. It’s about taking the lead.

Key Takeaways

- India’s global share in auto components is only 3%, despite strong domestic production.

- Cost disadvantages (10% vs. China) and limited presence in high-precision segments reduce competitiveness.

- Strategic policy reforms like PLI, FAME-II, and PM E-DRIVE are changing the game.

- Industry 4.0 technologies (AI, IoT, digital twins) are critical for global competitiveness.

- Sustainability and ESG compliance will be key for integration into global supply chains.

- India’s goal by 2030: $145B in production, $60B in exports, and 2.5M new jobs.

India’s Domestic Strength: A Robust Foundation

India’s automotive sector isn’t starting from scratch—it’s building on a strong domestic foundation. In FY 2023–24, India produced nearly 28 million vehicles, making it the world’s largest producer of two-wheelers. The sector contributes about 7.1% to India’s GDP and nearly 50% of its manufacturing GDP. That’s huge.

But here’s the kicker: when it comes to global trade in auto components, India lags. Both exports and imports hover around $20 billion, resulting in a trade ratio of 0.99. Compare that to Japan (4.0), South Korea (2.89), or even Germany (1.48), and you see the gap. India’s weakness lies in high-value areas—think engine and transmission components—which form the lion’s share of global component trade. That’s where change needs to happen.

The Cost Handicap and Structural Gaps

Despite enjoying lower labor and power costs, India faces a 10% cost disability compared to China. How? Higher material and capital equipment costs, steeper financing, and import duties all pile up. For instance, import duties and weaker depreciation benefits contribute to an extra 3.4% cost burden alone. Add higher taxes and financing hurdles, and it’s a tough hill to climb.

India needs systemic changes. Better integration in the supply chain, tech upgrades, and policy tweaks can bridge the gap. Without these, manufacturers find themselves priced out—even with natural cost advantages.

Policy Support: The Game Changer

Thankfully, the Indian government isn’t sitting idle. Policies like Make in India and Atmanirbhar Bharat are setting the tone, but it’s the Production Linked Incentive (PLI) schemes and EV-focused programs like FAME-II and PM E-DRIVE that are really pushing the envelope.

Here’s a quick look:

| Scheme | Budget Allocation | Focus Area |

| FAME-II | ₹11,500 crore | EV adoption |

| PM E-DRIVE | ₹10,900 crore | 2W and e-buses |

| PLI for ACC batteries | ₹18,100 crore | Battery manufacturing |

Demand-side incentives are backed by supply-side enablers—like capital subsidies and R&D grants—creating a full-spectrum push for transformation.

Shifting GVC Focus: From Basic to Complex Components

Currently, India plays mostly in the low-value zone—sheet metal, fasteners, and the like. To compete globally, that’s gotta change. The NITI Aayog report suggests moving toward high-tech and emerging areas: electric powertrains, ADAS (advanced driver-assistance systems), semiconductors, and smart electronics.

To help manufacturers navigate this transition, the report introduces a quadrant framework:

- Conventional-Simple

- Conventional-Complex

- Emerging-Simple

- Emerging-Complex

Each type gets a customized strategy—capex support, R&D funds, branding help, and more.

Cross-Sectoral Integration and Domestic Linkages

India’s auto sector doesn’t work in a silo. It’s tightly woven into the fabric of multiple industries:

- Steel: 15% of national output goes to auto.

- Rubber: Nearly 50% of domestic output consumed.

- Textiles and Leather: For seats, airbags, steering covers.

- IT and Electronics: Powering software and smart vehicle systems.

Firms like Infosys, TCS, and Wipro are developing software for everything from infotainment to vehicle control systems. That tech backbone is essential for EVs and autonomous driving.

Global Trade Dynamics: Who’s In, Who’s Out

India exports about 34% of its components to North America, 27% to Europe, and 19% to Asia. The U.S. leads the pack, importing $3.5 billion worth of Indian components. Germany and Turkey are also key partners.

On the flip side, India imports heavily from China ($2.8 billion), Germany, and South Korea. Alarming stat? Imports from China surged 80% between FY 2021 and FY 2024. That’s a red flag. The solution lies in import substitution through local manufacturing and joint ventures.

Learning from the World: Benchmarking Trade Performance

Take a look at how India stacks up:

| Country | Trade Ratio (Export/Import) | Component Exports ($B) |

| Japan | 4.0 | ~$45B |

| Germany | 1.48 | ~$55B |

| South Korea | 2.89 | ~$35B |

| China | 1.94 | ~$70B |

| India | 0.99 | ~$20B |

The numbers speak for themselves. India has the volume but lacks efficiency and strategic targeting. With the right policy mix and industrial push, there’s room to leapfrog.

Building the Ecosystem: Fiscal and Non-Fiscal Interventions

The roadmap includes both fiscal and non-fiscal tools:

Fiscal Measures

- Capex and Opex Grants: To build or upgrade production units.

- Subsidies: For raw materials, power, and logistics.

- Shared Infrastructure: Like testing centers and R&D hubs in clusters.

Non-Fiscal Measures

- Joint Ventures & Tech Transfer: Especially in EVs and semiconductors.

- FTAs: To improve market access.

- Supplier Discovery Platforms: Connecting global buyers with Indian firms.

Also on the agenda: skill development. A dedicated GVC Skilling India scheme aims to create a workforce ready for precision and high-tech manufacturing.

Tech Upgrade: The Industry 4.0 Imperative

Smart factories, AI, IoT, digital twins—these aren’t buzzwords anymore. German automakers like Audi are already producing multiple models on a single line using real-time customer data. India’s manufacturers must follow suit to stay relevant.

Key areas of tech adoption:

- Predictive maintenance

- 3D printing

- Connected supply chains

- Real-time demand forecasting

Embracing Industry 4.0 isn’t optional—it’s survival.

Green and Circular: The Sustainability Mandate

The world’s going green, and India must ride the wave. Global OEMs like Volkswagen and BMW are investing heavily in carbon-neutral operations and battery recycling. India needs to adopt similar ESG (Environmental, Social, and Governance) practices.

Ideas on the table:

- Carbon credits and green factory incentives

- Lightweight, recyclable materials

- Water and energy efficiency metrics

- Circular manufacturing loops

Sustainability isn’t just good PR—it’s fast becoming a trade requirement.

Jobs, Innovation, and the Road to 2030

The payoff? If all goes according to plan, India’s auto component industry could add 2 to 2.5 million jobs by 2030, hitting around 4 million direct jobs total. R&D ecosystems will mature, exports will rise, and India could become a global manufacturing hub for cost-effective, high-tech vehicles.

Conclusion

India’s automotive industry stands at a critical crossroads. With a strong domestic foundation, emerging policy momentum, and tech-readiness on the horizon, the stage is set for a global leap. But gaps in competitiveness, tech adoption, and ecosystem integration need urgent fixing.

The roadmap laid out by NITI Aayog offers more than just a blueprint—it’s a call to action. If industry and policymakers align and execute swiftly, India could evolve from a regional player to a global force in the next wave of automotive innovation. It won’t be easy, but with sustained effort and smart strategy, this could be India’s defining industrial moment of the decade.

FAQs

What is India’s current share in the global auto component market?

India currently holds a 3% share in the global traded auto component market, despite being the fourth-largest automobile producer in the world.

Why is India’s trade ratio in auto components so low?

India imports and exports nearly equal values of components (~$20B each), leading to a trade ratio of 0.99. This is due to limited production in high-value segments and higher manufacturing costs.

Which countries are India’s top export destinations for auto components?

The United States is India’s top export destination, followed by Germany and Turkey. Together, North America and Europe account for over 60% of exports.

How does India compare with China in automotive trade?

China exported $70B in components and imported $36B in 2024, with a trade ratio of nearly 2. In contrast, India’s ratio is under 1, indicating a need for better export competitiveness.

What are some key policy initiatives supporting the auto sector?

Major initiatives include the Production Linked Incentive (PLI) scheme, FAME-II for EV adoption, PM E-DRIVE for electric mobility, and PLI for advanced battery manufacturing.

How important is sustainability for Indian auto manufacturers?

Very. Global buyers increasingly demand ESG compliance. Investing in green manufacturing, recycling, and energy efficiency will be essential for accessing international markets.

What role does Industry 4.0 play in India’s automotive future?

Industry 4.0 technologies like AI, IoT, and digital twins will boost productivity, flexibility, and global competitiveness. Adoption is critical for moving up the value chain.

Reference: Automotive Industry: Powering India’s participation in Global Value Chains, Niti Aayog

Read more: Project Report for Electronics, Textiles, Auto Manufacturing Business