India’s Next-Gen GST reform combines broad rate reductions with faster, data-driven processes. Essentials, agriculture inputs and machinery, several healthcare and education items, select electronics, and value-segment automobiles move to lower GST slabs. Registrations and refunds are promised to be quicker. The opportunity is meaningful for manufacturers and consumers alike, provided companies execute a clean cut-over and protect accumulated input tax credit (ITC).

What is the Next-Gen GST Reform 2025?

The government has announced a rate-rationalisation that lowers GST on six large consumption and investment blocks, plus procedural changes.

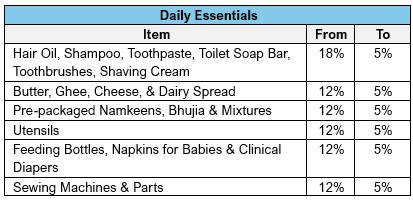

For daily essentials, items such as hair oil, shampoo, toothpaste, soap bars, toothbrushes, shaving cream, butter/ghee/cheese/dairy spreads, pre-packaged namkeens and mixtures, utensils, baby feeding bottles, napkins/clinical diapers, and sewing machines with parts move from earlier 12% or 18% rates down to 5%.

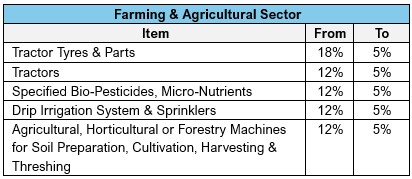

For farming and agriculture, Tractor Tyres and parts reduce from 18% to 5%, while tractors themselves, specified bio-pesticides and micro-nutrients, drip irrigation systems and sprinklers, and agricultural/forestry machines for soil preparation, cultivation, harvesting and threshing fall from 12% to 5%.

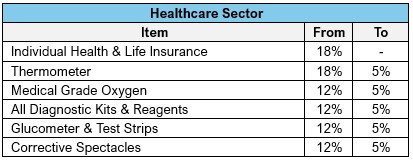

In the healthcare sector, individual health and life insurance shifts from 18% to nil, and thermometers, medical-grade oxygen, diagnostic kits and reagents, glucometers with test strips, and corrective spectacles move from 12% to 5%.

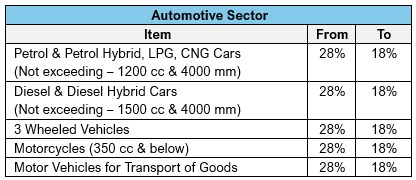

For automobiles sector, petrol/petrol-hybrid/LPG/CNG cars not exceeding 1,200 cc and 4,000 mm, diesel/diesel-hybrid cars not exceeding 1,500 cc and 4,000 mm, three-wheelers, motorcycles up to 350 cc, and goods transport vehicles reduce from 28% to 18%.

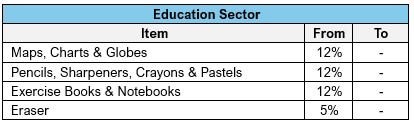

The education block takes maps, charts and globes, pencils/sharpeners/crayons/pastels, exercise books and notebooks from 12% to nil, and erasers from 5% to nil.

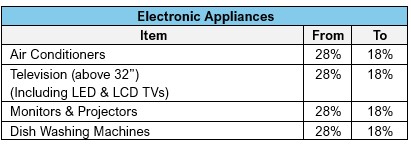

The electronics & appliances block lowers air conditioners, televisions above 32 inches (including LED/LCD), monitors and projectors, and dish-washing machines from 28% to 18%.

Alongside these rate cuts, it highlights process reforms such as analytics-based automatic registration within about three working days and provisional refunds sanctioned through system-based risk evaluation for zero-rated supplies and inverted-duty cases. Final applicability always depends on the formal rate notifications and circulars.

Why has it been introduced?

Policy intent is to ease the cost of living, improve MSME competitiveness, and stimulate demand in price-sensitive categories, while advancing administrative efficiency through quicker registrations and refunds. Lower incidence at the final point of sale should help formalise trade, compress working capital in supply chains, and support growth.

Which product manufacturers stand to gain?

Manufacturers in FMCG and home-and-personal care benefit from reduced output tax on toiletries and ready-to-eat snacks. Kitchenware and sewing-machine makers gain from lower rates that support accessible price points. Healthcare suppliers benefit from reductions on thermometers, oxygen, diagnostics, glucose testing and spectacles, while mother-and-child categories become more affordable. Producers of school supplies gain from lower or nil GST. Agriculture equipment and input makers from tractors and tyres to bio-pesticides, micronutrients and irrigation systems receive a competitive push. Electronics and appliance makers of ACs, larger TVs, monitors and dishwashers, as well as automotive manufacturers of small ICE/hybrid cars, three-wheelers and commuter motorcycles, can recalibrate sticker prices.

How should the transition mechanism work so ITC isn’t lost?

Businesses should map time-of-supply rules for advances, invoicing and deliveries that straddle the effective date and issue credit or debit notes to re-rate earlier invoices so counterparties’ credits remain intact. ERP and POS masters must be updated for HSN codes, tax tables, pricing and MRP logic, with day-zero testing. Inventory carried at old prices should be relabeled per Legal Metrology, with auditable records.

Where output rates fall to 5% but key inputs remain at 12%–18%, firms should file periodic refunds under section 54(3) to manage inverted duty and track input-service credits separately where refunds are restricted. Contracts and purchase orders should be amended with change-in-law and price-variation clauses, and clear dealer communications should set out price protection and documentation for credit claims. Maintaining a contemporaneous anti-profiteering file will reduce later disputes.

Which industries may face higher input GST that cannot be fully offset?

Sectors where output shifts to 5% are vulnerable to inverted duty because major inputs and services often remain in the 12%–18% band. FMCG producers of toiletries and savoury snacks typically buy chemicals, fragrances, laminates, corrugated packaging and marketing services at higher rates; refunds for input-service ITC are usually restricted, creating ITC build-up. Agriculture-machinery manufacturers taxed at 5% will continue to buy steel, tyres, electronics and fabrication or assembly services at 18%, while utensil and sewing-machine makers face similar dynamics on metal parts and job-work. In all such cases, working-capital pressure rises unless refund cadence and documentation are strong.

Why might some end-customer prices not fall despite Next-Gen GST Reforms?

Retail prices may take time to adjust because distributors hold inventory purchased at the older, higher tax incidence and must receive price protection before passing on reductions. Input-cost trends, metals, energy and freight, can neutralise tax savings in ex-factory pricing. Where inverted duty persists and input-service ITC cannot be refunded, manufacturers may preserve margins rather than reduce tags immediately. In regulated or promotion-driven categories, benefits may be delivered as added grammage, longer warranties or bundled offers instead of sticker-price cuts. In niches with limited competition, firms may prioritise margin repair under anti-profiteering oversight.

What complications can be expected during transition?

Common risks are straddling-supply mismatches between advances and deliveries, day-one rate errors from stale ERP or POS masters, and downstream mismatches between GSTR-1 and GSTR-3B when credit notes are mis-timed. Re-stickering MRPs can pose compliance challenges across states, and grey-zone classifications, for example, the scope of “specified” agricultural inputs, can trigger interpretational queries. Disputes can also arise over whether a reduction should be compensated via GST credit notes or commercial notes, with consequences for the recipient’s ITC.

What is the impact on the ongoing US trade or tariff tensions?

GST is a domestic value-added tax, while US tariffs are border measures, so direct effects are limited. Indirectly, lower domestic tax incidence reduces India’s cost base and can improve export price-competitiveness in agricultural equipment, auto components, electronics sub-assemblies and FMCG inputs. However, any US tariff barriers remain unchanged, and exporters must continue to rely on zero-rated GST, duty drawback and RoDTEP to achieve tax neutrality.

What professional work will arise for tax practitioners and tax consultants?

Advisory demand will centre on product-wise rate and HSN mapping, cut-over playbooks for time-of-supply and re-invoicing, anti-profiteering computation and documentation, and the design of refund routines for inverted duty and zero-rated supplies. Practitioners will also be needed for ERP and POS reconfiguration and testing, contract rewrites that embed change-in-law and price-variation, litigation or rulings on classification grey areas, and structured training for finance, procurement, sales and channel partners to ensure day-zero readiness.

Reference: Govt. of India, Press Information Bureau