What is a Merger or an Acquisition?

Merger and Acquisitions are a type of corporate transaction that involves two or more companies, but there is a difference in the structure of the transaction as well as ownership of the companies.

A merger is a transaction where two or more companies combine their operations and form a single new entity. It is done by consolidating all their assets and liabilities. The original combining companies seize to exist when the new entity is created. The shareholders of the merging companies usually receive shares in the newly formed entity in proportion to their ownership in the original companies.

Whereas an acquisition, also known as a Takeover, is a transaction wherein a company purchases the majority or all the ownership stakes of another company thereby dissolving its operations. The acquiring company remains intact, and the company being acquired is either converted into a subsidy or is completely absorbed by the acquirer. Here, the ownership of the acquired company gets transferred to the acquirer and the shareholders of the acquired company either receive cash, shares, or a combination of both as compensation for their ownership stake.

The terms merger and acquisition have distinct characteristics but are often used interchangeably, especially while referring to transactions involving the consolidation of companies. The specific terminology used can be dependent on legal and financial considerations, as well as the structure and nature of the transaction.

Types of Mergers:

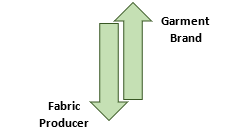

Vertical Merger:

This merger happens when two businesses in the same industry share a manufacturing line yet operate independently of one another. An illustration of a vertical merger would be a garment brand buying a fabric producer.

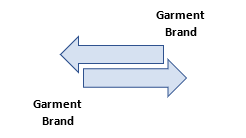

Horizontal Merger:

This merger acts similarly to vertical mergers, although the two businesses are frequent rivals and operate in the same industry. This kind of collaboration is formed to reduce costs and streamline production while outpacing market competition.

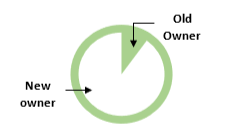

Stock Merger:

Stock Acquisition is also called a “Hostile Takeover.” In this, the company is completely taken over by another company or an individual with or without the involvement of the business owner and the acquirer has the power to make the changes and control the organization.

Conglomerates Merger:

This forms when two businesses from different areas come together to expand quickly into new markets and diversify their product lines. The united businesses can dominate several markets, providing a backup plan in case one of their product lines falters.

Concentric Merger:

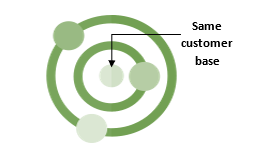

This merger requires two or more businesses operating in parallel but separate industries. When those businesses have comparable requirements for manufacturing or distribution routes, such as when a car firm buys a tire company, an alliance of this nature is advantageous.

Asset Purchase:

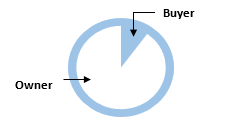

This purchase is used by businesses that only desire certain assets from other businesses, not their existing liabilities or their entire business. While the owner would still be accountable for the liabilities, the buyer would own the profitable areas.

Types of Acquisitions:

- Friendly Acquisition: This acquisition happens when a company willingly agrees to be acquired by the acquiring company. Both the parties entering into the contract negotiate and reach an agreement on the terms and conditions of the acquisition.

- Strategic Acquisition: The driving force behind this acquisition is the acquiring company’s long term strategic objectives. The company aims to acquire specific benefits from the acquired company that align with its business growth strategies in terms of technology, market access, or product lines. This acquisition can help companies to enter new markets or to enhance their competitive advantage.

- Financial Acquisition: This acquisition is also known as a Financial Buyout or an Investment Acquisition, which occurs when a company or a group of investors acquires a stake in a target company with the aim of generating financial returns. The focus is on the acquired company’s profitability, cash flow, as well as potential for growth or restructuring.

- Reverse Acquisition: In this acquisition, a company with a smaller market value acquires a company with a higher market value. This acquisition helps the smaller company to gain benefits from the resources of the larger company, its market presence, or its financial strength.

Growth Opportunities in India for Merger and Acquisition:

- Consolidation of major industries: It is anticipated that Merger and Acquisition activity in India will continue in key industries including banking, insurance, telecommunications, and e-commerce. Companies can acquire economies of scale through sector consolidation, grow their market share, and gain access to fresh talent and technology.

- Focus on digital transformation: Merger and Acquisition activities in the digital sector is projected to expand as India continues to digitize and adopt new technologies. To increase their digital capabilities and consumer experiences, companies are likely to partner with or buy technological startups.

- Cross-border transactions: As Indian businesses aim to expand internationally, and as foreign businesses aspire to invest in India, cross-border Merger and Acquisition activity is projected to rise. The recent easing of restrictions on foreign investment is anticipated to make cross-border transactions much easier.

- Focus on sustainable growth: As environmental and social issues become more pressing, Merger and Acquisition activity in India is projected to place a strong emphasis on sustainable growth and ESG (Environmental, Social, and Governance) factors. Businesses that prioritize sustainability and ESG considerations in their Merger and Acquisition activity are likely to generate more long-term value and investor interest.

Indian Government Interventions in Mergers and Acquisitions:

These interventions are primarily aimed at promoting fair competition, protecting consumer interests, safeguarding national security, and ensuring compliance with regulatory frameworks.

- Competition Law: To stop anti-competitive practises, the Competition Commission of India (CCI) regulates merger and acquisition activities. Parties engaged in mergers or acquisitions must meet specific requirements and apply for CCI clearance. The CCI evaluates how the transaction will affect competition in the relevant market and, if determined to follow the Act’s provisions, approves it.

- Sector-Specific Regulations: In India, many industries, like telecommunications, banking, insurance, and media, have regulatory bodies in charge of regulating M&A activity. For instance, the Insurance Regulatory and Development Authority (IRDAI) governs M&A in the insurance industry, the Reserve Bank of India (RBI) controls M&A in the banking sector, and the Telecom Regulatory Authority of India (TRAI) manages M&A in the telecom sector. To ensure compliance with sector-specific regulations, these regulatory authorities examine and approve M&A transactions within their respective industries.

- Foreign Investment Regulations: Foreign direct investment (FDI) is governed by rules and regulations in India in several different industries. For reasons including national security, the preservation of domestic businesses, or strategic concerns, the government imposes limitations and requirements on foreign ownership and control in specific industries. To ensure compliance with FDI legislation, the Department for Promotion of Industry, and Internal Trade (DPIIT) monitors FDI policy and examines M&A deals involving foreign investors.

- National Security Review: The Indian government has the authority to examine and perhaps prohibit mergers or acquisitions that could have an impact on the country’s security. The Ministry of Home Affairs oversees conducting security reviews of potential Merger and Acquisition deals, particularly in industries like key infrastructure, telecommunications, and defence.

- Taxation: The Indian government has tax laws that could influence Merger and Acquisition deals. The Income Tax Act has clauses that deal with how M&A transactions are taxed, including capital gains tax, transfer pricing guidelines, and the financial ramifications of restructuring arrangements.

Few Examples of Merger and Acquisition:

Tata Group and Air India:

Vistara is a 51:49 JV between Tata Sons and Singapore Airlines Limited (SIA), shall be merged with Tata Sons fully owned airlines, Air India. Tata Sons had acquired 100% stake in Air India on 27th January 2022 via its fully owned subsidiary, Talace Private Limited (Talace). The transaction is estimated to complete in March 2024. Vistara shall be merged with Air India post receipt of the requisite approvals. According to the merger transaction, SIA shall also invest Rs. 2049 Crore in Air India and will hold 25.1% of shareholding in Air India, post consolidation.

HDFC Ltd. and HDFC Bank

The merger of HDFC Limited (Housing Development Finance Corporation Limited) and HDFC Bank will be effective from 1st July 2023. The Housing Finance Company and Private Lending Company will merge to become one company with a market capitalization of Rs. 14.37 Lakh Crore.

The deal was signed in April 2022, to make the bank more competitive and to give access to a large customer base to sell its products.

Axis Bank and Citi Bank

Axis Bank has completed its strategic acquisition of Citi Banks’ consumer business, which includes loans, credit cards, wealth management, and retail banking operations. The deal also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising asset-backed financing business, which includes commercial vehicle and construction equipment loans, as well as the personal loans portfolio.

To know more about our work related to mergers and acquisitions, click here.